Sometimes it is important to distinguish between the trend and the "trend" of data.

Yesterday's post looked at the trend of debt relative to GDP. Looked at how to look at the trend. If the debt-to-GDP ratio is pushed up by a bubble, I'm not comfortable with the idea that the trend goes up. I think the trend is where it would have been without the bubble, and the bubble is an anomaly.

Likewise, if the debt-to-GDP ratio is pushed down by unacceptably high inflation, I'm not comfortable saying that the trend goes down. The trend is where it would have been without the inflation, and the inflation is an anomaly.

Of course, these thoughts depend on a "where it would have been" version of the trend, which is as fanciful a measure as Potential GDP or the natural rate of unemployment.

But I'm not comfortable with the idea of taking "debt in a normal economy", adding in "debt from bubbles", figuring something like a moving average of the two, and calling that average the trend. It's just not right. The trend is the trend, and the bubble is the bubble. You don't average them together and call that the trend.

Still, there may sometimes be reasons to ignore the "where it would have been" line.

I've been reading Credit, Financial Conditions, and Monetary Policy Transmission (the "preview" PDF, 39 pages, from the AEA) by David Aikman of the Bank of England, and Andreas Lehnert, Nellie Liang, and Michelle Modugno of the Federal Reserve Board. It is strikingly good.

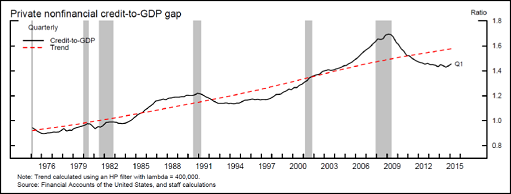

I interrupted my reading of the AEA PDF to write yesterday's post when I saw how they decide whether the credit-to-GDP ratio is high or low. They figure the trend (bubbles and all) and compare the ratio to the trend.

They use a "slow-moving" trend, meaning it varies more slowly than the ratio itself. Much more slowly: They use a "smoothing factor" of 400,000 when the standard value is only 1600. So their trend line is nearly straight:

|

| Graph #1: Private Non-Financial Credit relative to GDP, with Trend This graph is from the "PowerPoint" download at the AEA page. |

If you happen think debt went high around 1980, then you see everything after 1985 on the graph as high. You may not be comfortable saying that debt in 2012 was "low".

You are not alone. In the PDF they note that

Even after falling significantly from its peak in 2009, the level remains elevated relative to previous decades.

In other words, debt is high. Their statement is a strong objection to the methodology that they use. I like the honesty. I take their statement as evidence that the authors of the PDF are not completely comfortable saying that debt was low in 2012. This is big. To me it means they are on the right track: They agree with me!

They do justify the methodology by saying everybody does it that way:

We follow the literature in defining the credit-to-GDP gap as the difference between the ratio of nonfinancial private sector debt to nominal GDP and an estimate of its trend...

That doesn't make it right, of course. But wait for it: They do make it right.

Why do I object so strongly to their trend calculation? Because comparing the debt ratio to a rising trend makes the ratio seem lower than it really is.

They understate the level of debt by circular logic: They figure how high debt is by comparing it to the trend when, all the while, high debt has been driving the trend up! It's madness.

But it turns out there is method in their madness. They say:

A concern with using measures based on credit-to-GDP is the upward trend in the ratio. As an empirical matter, this is dealt with by focusing on the gap with respect to an estimate of the trend designed to be slow moving.

They worry that critics might question the validity of their work because of the upward trend of the ratio. In order to circumvent that criticism, they measure how high the debt-to-GDP ratio is by comparing it to its trend. If the ratio is above the trend, they call it high. This way, when they say debt is high, no one can contradict them.

Okay. For me, their methodology weakens their argument. But if it strengthens their argument in the eyes of someone who doesn't see debt as a problem, it's worth it.

Good job, guys. But don't forget: After you convince the critics that you're onto something, you'll have to open their minds further and get them to move away from comparing debt to trend to determine whether debt is high.

Just tell 'em their logic is circular.

3 comments:

Regarding the smoothing factor of 400,000 see Reddit

https://www.reddit.com/r/Economics/comments/87qgnh/ecb_detrending_and_financial_cycle_facts_across/

and the PDF linked there

https://www.ecb.europa.eu//pub/pdf/scpwps/ecb.wp2138.en.pdf

48 pages

Abstract:

I show that the detrending of financial variables with the Hodrick and Prescott (1981, 1997) (HP) and band-pass filters leads to spurious cycles. I find that distortions become especially severe when considering medium-term cycles, i.e., cycles that exceed the duration of regular business cycles. In particular, these medium-term filters amplify the variances of cycles of duration around 20 to 30 years up to a factor of 204, completely cancelling out shorter-term fluctuations. This is important because it is common practice, and recommended under Basel III, to extract medium-term cycles using such filters; e.g., the HP filter with a smoothing parameter of 400,000. In addition, I find that financial cycle facts, i.e., differing amplitude, duration, and synchronisation of cycles in financial variables relative to cycles in GDP, are robust. For HP and band-pass filters, differences to GDP become marginal due to spurious cycles.

See also David Glasner, Williamson v. Sumner, quoting from

Andrew Harvey’s article on filters for Business Cycles and Depressions: An Encyclopedia:

"Thus for quarterly data, applying the [Hodrick-Prescott] filter to a random walk is likely to create a spurious cycle with a period of about seven or eight years which could easily be identified as a business cycle . . . Of course, the application of the Hodrick-Prescott filter yields quite sensible results in some cases, but everything depends on the properties of the series in question."

MORE spurious cycles??!!!

FOR MORE ON THE 400K SMOOTHING FACTOR SEE

the commentary on the second graph at this FRED Blog post:

What’s a countercyclical capital buffer?

They say:

"The Basel Committee, an international body that set initial international guidelines on the use of CCyBs, recommends detrending with a Hodrick-Prescott filter with a lambda value of 400,000."

Why detrend the debt-to-GDP data?

"to ignore any long-run movements in the ratio unlikely to be associated with any given financial crisis."

But this explanation rests on the assumption that an increase in the ratio that is "unlikely to be associated with any given financial crisis" is a harmless increase.

Post a Comment