On the 20th I looked very briefly at NGDP targeting as presented by Marcus Nunes. Marcus gracefully responded, and now I have much to chew on. Or choke on, maybe. I will try to understand and respond by 4AM on the 21st.

Good thing I don't sleep much.

Marcus, sir... First: I think you are very good with graphs. I looked at your examples and was almost convinced by them, even before I understood what you were saying. But I find I must put you in the third person!

In

The finding that monetary developments were crucial to the recovery implies that self-correction played little role in the growth of real output between 1933 and 1942.

...and responds:

This shows she´s a true believer in the power of monetary policy.

I like that. (There is more, both more from Romer and more reaction from Marcus. I'm quoting the parts I like.)

"Self-correcting" is not the best phrase for the occasion. It implies that the economy might change in ways that "correct" problems. And oh yes, I'm sure it does. But the things we think of as problems are not the same as the things the economy treats as problems. Mostly, the things we think of as problems are the economy's responses to things that are problems for it. Things like an imbalance in the money -- an excess of credit-use relative to the quantity of money in circulation -- which leads to stagnation and to inflation and to high unemployment, for example, and to large Federal deficits.

Evaluating Romer's article and reactions to it, Marcus writes:

Phillips Curve arguments don´t need to be evoked. Inflation can rise or fall with unemployment. What transpires depends on the kind of shocks that are hitting the economy at the particular time and, most importantly, whether MP is geared (explicitly or implicitly) to stabilize nominal spending.

So I want to say Marcus relies on shock theory. I don't think Adam Smith did. And I don't think Keynes did. And I don't, either. I still rely on supply and demand. An oil "shock" ought to boost oil prices, and oil profits, and lead to an expansion of oil supply. If it doesn't, and if it doesn't lead to energy diversification, then there are probably other problems at root besides "shocks". But that's just me.

So when Marcus gets more into shocks, fretting over the kind of shocks that are hitting the economy, I just hear an empty argument.

Marcus drives his train of thought from the Phillips Curve to a focus on gearing monetary policy ("MP") "to stabilize nominal spending."

I wouldn't do that. I would start with his opening thoughts:

Phillips Curve arguments don´t need to be evoked. Inflation can rise or fall with unemployment.

I would make sure you know that the term "Phillips Curve" implies a trade-off between inflation and unemployment. And I would make sure you know that when we say Inflation can rise or fall with unemployment, we are contradicting the implication of the Phillips Curve.

And I would say yes, Marcus is right: Events sometimes contradict the hundred years or more of empirical evidence supporting the implications of the Phillips Curve. And I would say the single most important question to be asked is: Why?

//

In the same post Marcus writes, "But only one thing “anchors” expectations and that is Fed credibility." He sees expectations as the cause of inflation, and credibility as the dampener. I'm sure there's a lot of support for such ideas, arisen in the last 40 years. I'm not impressed. The last 40 years has been all bad.

Show me Adam Smith focusing on expectations and credibility. Show me Keynes focusing on expectations and credibility. Yeah, Keynes wrote of animal spirits. But he said of expectations, that people generally expect existing conditions to continue. As a basis for macroeconomic theory, expectations is thin.

//

Marcus recommends his Figures 1 and 2 from the post. Both figures show, more or less, that the difference between NGDP and RGDP comes out as inflation. Figure 1 considers the Great Inflation. Figure 2 considers the Great Moderation. Marcus concludes:

If the Fed keeps nominal spending growth stable around a trend path, inflation will most likely remain low and stable and RGDP growth will evolve close to “potential”.

Sounds like magic to me. What I don't get is, what will drive the increase in real growth? What prevents the increased quantity of money from generating nothing but inflation? The only explanation I see so far is that we should try to mimic what happened during the Great Moderation, and we should expect that inflation and RGDP will respond as they did during the Great Moderation.

But what's behind the curtain? If Marcus is telling me, I don't see it yet.

//

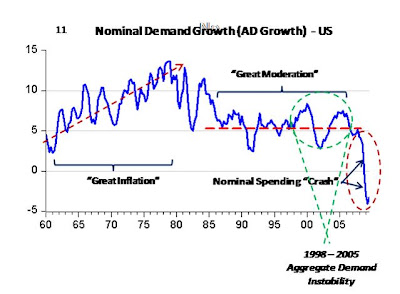

In his second link, The crisis from an AD perspective, Marcus wants us to look at Figures 11 and 12.

I was very quick with Marcus's first link. Perhaps he has a really good explanation there and I missed it because I was rushing too much. So let me take a different tack with his second link. It's a good one to take some time with. Marcus writes, "This one sort of lays down my views on NGDP LT."

"NGDP LT" is Nominal GDP Level Targeting. Somewhere in one of the posts he links, he points out that Level Targeting is better than Rate targeting because it follows a trend. And if you go off-trend, the trend continues to remind you of where you ought to be. And then policymakers should push to get back to the trend.

Dunno about that. The Bullard's Earthquake view is that the trend of potential output has suddenly fallen, and there is now a new and much lower trend. Seems to me Bullard would totally disagree with Marcus, and Marcus with Bullard. But anyway, Marcus writes:

Figure 11 shows the behavior of AD (nominal expenditure growth) in the US over the last 50 years. It is relatively straightforward to associate this behavior to the periods that became known as “The Great Inflation” and “The Great Moderation”.

In the 1960´s and 1970´s the focal variable was the unemployment rate. During the Kennedy-Johnson administrations AD shocks, from MP and Fiscal Policy (FP), parted a positive bias to AD growth.

In the 1970´s, characterized by negative supply shocks (notably oil prices), increases in AD to compensate for the negative effects of the shocks on unemployment and RGDP growth resulted in high and rising inflation.

In the 1960´s and 1970´s the focal variable was the unemployment rate. During the Kennedy-Johnson administrations AD shocks, from MP and Fiscal Policy (FP), parted a positive bias to AD growth.

In the 1970´s, characterized by negative supply shocks (notably oil prices), increases in AD to compensate for the negative effects of the shocks on unemployment and RGDP growth resulted in high and rising inflation.

Shock theory, again. Y'know what? Let me jump back to one of Marcus's comments on mine of the 20th. He quotes me:

I think other factors are involved in the rise of inflation and the decline of GDP.

And he responds:

If you are thinking that the first and second oil shocks are among those "other factors" involved, think again. The oil rise was a consequence of the (previous) rise in inflation!

Oh, yeah. I know. Marcus is saying that there were inflation troubles before the oil shocks of the 1970s. But if we jump back to the whitebox excerpt above, Marcus seems to say that inflation was a result of the policy response to oil shocks. Is there some contradiction here?

//

One more point from Marcus's second, and that's it for tonight. I'll leave out the Figures and just quote the text:

As indicated in figure 3, in mid 2006 house prices began to fall. From this moment the delinquency rate began to grow affecting the health of important financial institutions. A few (New Century Financial, for example) went broke already at the

beginning of 2007.

Notable, however, is the fact that between 2006 and mid 2008 AD growth was kept relatively stable and close to the trend path. Therefore, in spite of the crisis, the adjustments in the economy were able to proceed in an “orderly fashion”.

'Nother words, when Aggregate Demand growth is kept fairly stable (as under NGDP Targeting) the economy can weather severe financial troubles. That's interesting. Not sure it's safe to generalize from one example, but it's interesting.

//

Okay, it's almost midnight and my eyes are starting to cross. Marcus linked to another post, but maybe I'll look at that one separately.

I'm out.

1 comment:

NA - "Anchors", "shocks", I agree are "funny" terms that economists have borrowed from other fields...

Just a quickie on why it was inflation that drove oil prices.

The sheik had 10 wifes to whom he had promised a new Caddillac every year. Around 1965, Caddillac prices start trending up. The gift becomes expensive because his intake from oil sales is fixed at $3/barrel. So he takes advantage of the BW system of fixed fx rates (and the fact that US inflation had not yet been "exported" to Germany) and gets his wifes to accept Mercedes instead. But Nixon spoils his game by closing the Gold Window on August 15 1971 and the dollar depreciates against the DM. So now, Caddillacs are unaffordable but so are Mercedes. His intake remains at USD 3/B. The wifes begin a "revolt". He calls up his peers and puts OPEC (founded in 1960 but had not done anything) and they agree to increase oil prices by a factor of 4! The wifes are happy again with their new cars.

Post a Comment